House Republicans Push Forward with $880B Medicaid Cuts to Advance Trump's Agenda

The House Republicans plan to move forward on Tuesday with major parts of their legislation aimed at financing President Donald Trump’s policies, which include tax reductions and cuts to Medicaid. This push comes despite ongoing disagreements on various crucial matters.

The House Energy and Commerce Committee, responsible for overseeing energy and healthcare initiatives, along with the House Ways andMeans Committee, which manages tax-related matters, plan to conduct extensive markup sessions in an effort to advance the bill towards the voting stage.

The movement on the critical pieces of the “big, beautiful bill” comes as Speaker Mike Johnson faces resistance from different wings of his caucus with only three votes to spare in his razor thin majority.

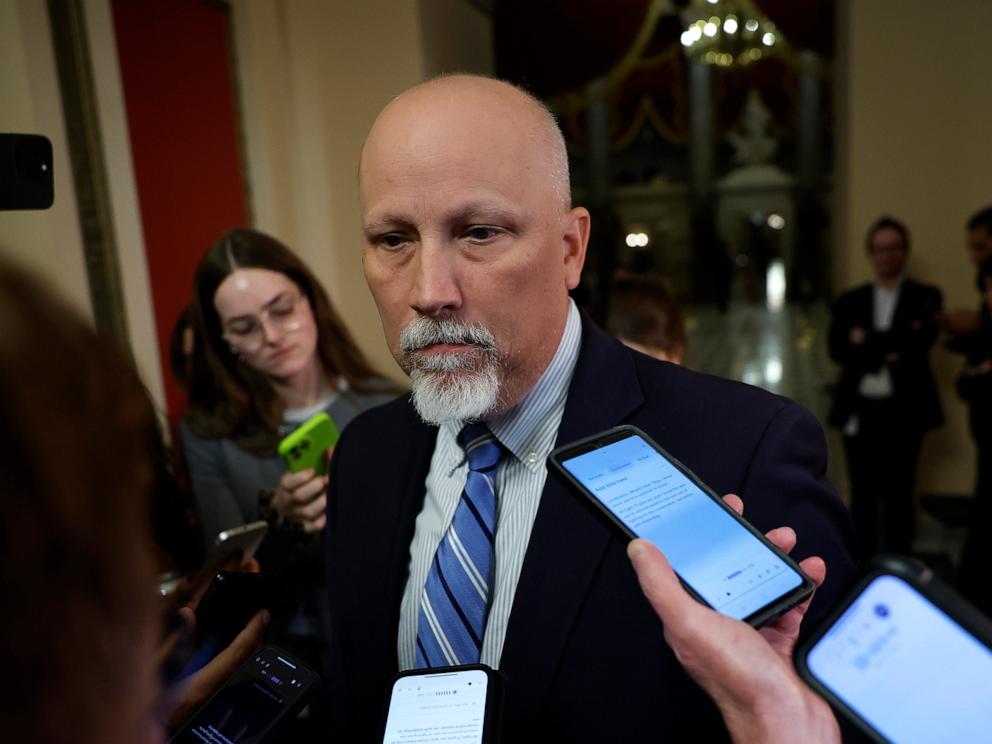

MORE: Cloud of uncertainty hangs over House GOP proposal to reach $880 billion in savingsTexas GOP Representative Chip Roy stated on Monday that he opposes the current proposals and requires "substantial" modifications before being able to endorse the final package.

“I remain open-minded because progress has been made based on our forceful efforts to force change. But we cannot continue down the path we’ve been going down - and we will need SIGNIFICANT additional changes to garner my support,” he said in a post on X.

Trump made repeated assurances during his campaign and time in office that he would refrain from reducing Medicaid benefits. He and fellow Republicans also stated their intention to find cost reductions within the program by eliminating waste and fraudulent activities.

As he prepared for his four-day journey to the Middle East on Monday, he encouraged Republicans to come together and support the bill. He mentioned an executive order signed earlier that day aimed at reducing the price of prescription medications. Additionally, he noted that hundreds of billions from tariffs should also be considered when evaluating the legislation’s impact.

As Republicans have taken charge of both houses of Congress, they are employing a procedure known as reconciliation, which necessitates merely a simple majority for approval, to swiftly advance their legislative agenda.

Over the weekend, Republicans released legislative content detailing their proposals to reduce Medicaid expenditures through employment conditions for beneficiaries, conduct more regular eligibility assessments, and impose penalties on states such as New York and California that provide Medicaid to undocumented individuals.

The Congressional Budget Office wrote in a letter to Energy and Commerce Chairman Brett Guthrie that the proposal met its lofty target for $880 billion of savings over the next decade.

The Energy and Commerce committee resisted pressure from hardliners like Roy who demanded GOP leaders propose lowering the percentage the federal government pays to states’ Medicaid programs or include per-capita caps on federal Medicaid payments to states.

MORE: House passes bill to make 'Gulf of America' name change permanentThe sections related to healthcare would result in savings of approximately $715 billion, as estimated by the CBO. Nonetheless, an additional 8.6 million people in America will lose their insurance coverage.

Some culture war issues were addressed in the bill, including a provision to strip Medicaid funding from organizations that offer abortion services such as Planned Parenthood.

The legislation has faced opposition from Republican senators in the Senate who must comply with it, such as Missouri’s Senator Josh Hawley. He published an op-ed in The New York Times on Monday cautioning against cuts to Medicaid.

“This wing of the party wants Republicans to build our big, beautiful bill around slashing health insurance for the working poor. But that argument is both morally wrong and politically suicidal,” Sen. Hawley wrote.

Meanwhile, the Ways and Means Committee, which is marking up the tax portion of the bill, outlined a permanent extension of Trump’s 2017 Tax Cuts and Job Act, as well as making good on his campaign promises like no tax on tips and no tax on overtime.

The plan would temporarily increase the child tax credit, create a MAGA savings account for children and temporarily increase the standard tax deduction. It also calls for a $4 trillion increase to the debt ceiling, which Congress must address by mid-July to avoid default.

MORE: Trump supports higher taxes for the rich, but says GOP 'should probably not do it' in billThe legislation also includes one of the most controversial components -- a tax proposal that would hike the cap on state and local tax deductions (SALT) from $10,000 to $30,000 for those earning less than $400,000, which some moderate Republicans from states with higher taxes say is not enough.

New York Rep. Nick LaLota said he is “still a hell no” in a post on X.

Rep. Mike Lawler of New York told Bloomberg TV the proposal was “woefully inadequate,” adding that he will vote against the bill if it comes to the floor.

“We will continue to work in good faith with leadership, with the administration to get this done, but we need to have an honest and serious discussion about the issue,” he added.

Here's what's in the bill:

Medicaid cuts

Medicaid work requirements: The bill would impose work requirements on able-bodied Medicaid recipients -- at least 80 hours per month -- or require enrolling in an educational program for at least 80 hours or some combination per month.

More frequent eligibility checks: This law would mandate states to perform eligibility assessments more often — reducing the current interval from once per year to twice per year.

Prohibits Medicaid funds for gender transition for minors: This legislation would prohibit federal Medicaid money from being used for gender-affirming treatment of transgender youth.

Restricts Medicaid funding for individuals who are not citizens: Federal funds would be prohibited from being directed to states that offer health care services through Medicare to migrants who are residing in the country illegally.

Aims to reduce Medicaid funding for entities that offer abortion services: This provision contains wording that would effectively bar healthcare providers offering abortion services from being eligible for Medicaid funding.

Drug pricing: This legislation amends the Inflation Reduction Act to permit medications approved for treating several conditions to be excluded from Medicare’s drug price negotiations.

Reduces funding for energy initiatives in the Inflation Reduction Act: The proposal aims to reduce funds for initiatives under the Inflation Reduction Act such as expenditures related to electric vehicles, recover climate-focused federal financial support, and gradually eliminate incentives for clean energy.

Tax provisions

No tax on tips: A huge tax break for the service industry and a provision that was also trumpeted by Kamala Harris as the Democratic nominee for president, though she tied the tax break to an increase for the federal minimum wage. This is temporary and would expire at the end of 2028.

No tax on overtime: Would relieve millions of Americans who work overtime. This is temporary and would also expire at the end of 2028.

Extension of 2017 Tax Cuts and Job Act: Ensures that the tax cuts introduced under the 2017 Tax Cuts and Jobs Act become permanent; excludes any provisions for increasing taxes on those with the highest incomes. Trump stated earlier this week that he doesn’t want the plan to hike taxes on wealthy individuals, "though I’m fine if they decide otherwise!!"

Creation of MAGA savings account for children: The contribution limit for any taxable year is $5,000. It includes a pilot program to start the accounts with $1,000.

SALT: Lifts state and local tax deduction cap to $30,000 with an income phase-down above $400,000. Married couples filing taxes separately are subject to a $15,000 cap and phase-down above $200,000 income.

Debt limit increase: This proposal involves raising the debt ceiling by $4 trillion. According to Treasury Secretary Scott Bessent, legislators need to tackle the debt limit issue by early July to prevent a potential default.

Increased tax relief for older adults: Senior citizens would receive an additional $4,000 in their standard tax deduction, with certain income restrictions applying. However, this provision is set to be only temporary and will lapse at the conclusion of 2028.

Imposes an excise tax on colleges: The institutions having an endowment exceeding $2 million for each pupil would rise from 1.4% to 21%, focusing particularly on Ivy League universities. However, religious colleges would not be included under this rule.

Child tax credit: An interim boost up to $2,500 from $1,000 until 2028, then reduced to $2,000 thereafter. Beneficiaries must possess a Social Security number.

Deduction for qualified business: The proposed legislation aims to raise the deduction for qualified business income from 20% to 22%.

Expands enhanced exemptions for estate and gift taxes: Would raise the estate and gift tax exemption to $15 million.

Elevates standard tax deduction: This plan introduces several new tax reductions, such as increasing the standard deduction temporarily to $32,000 from $30,000 for joint filers in 2025, and boosting it to $16,000 from $15,000 through 2028.

Post a Comment for "House Republicans Push Forward with $880B Medicaid Cuts to Advance Trump's Agenda"

Post a Comment